Climate change experts warn the planet is going to be smashed more often by stronger, more destructive disasters. This has grave implications for the marine insurance industry – if you want cover you’ll need to help by protecting your boat. By John Curnow.

This blunt message comes from James MacPhail, managing director of Australia’s Pantaenius Sail and Motor Yacht Insurance. Against a backdrop of more natural disasters happening in quick succession, no one will be able to get marine cover – unless there’s a marked change in attitude.

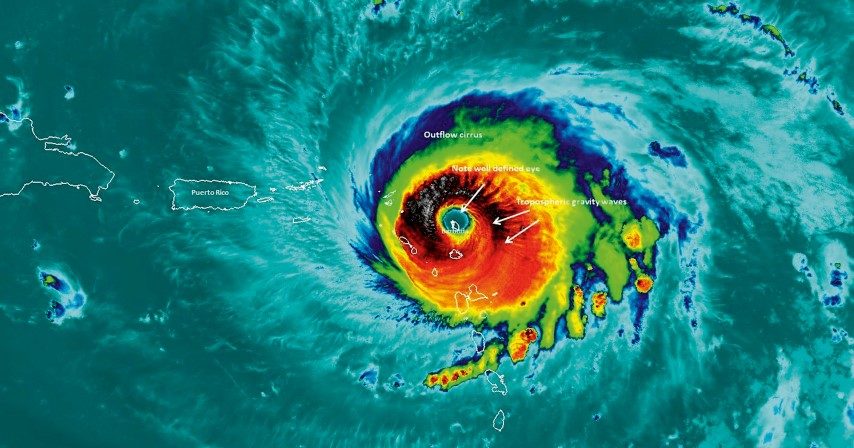

The insurance market, says MacPhail, has changed. “We’ve been expecting a crunch for quite some time and knew it was going to come as a result of all of the claims, most specifically out of the Caribbean storms (Irma and Maria).

“And we have been doing our best to educate the market and our client base. Our message has always been consistent: a policy is where the insured and the company jointly take on the responsibility to secure the asset and look after the risk.

“It is incumbent on boat owners – particularly in storm-affected areas – to ensure that they’ve done their due diligence and everything they can to best protect their asset. Only those people that go to these lengths can honestly expect to be reimbursed to the full extent of the policy.”

He points out that there are many examples where owners received a lower payout for failing to do their part. They did not take precautions and used the excuse that they were living away from the vessel’s locale, or that they did not know anyone close to the boat at the time of the storm. They claimed they were unable to pack up their boat, couldn’t put their sails away or store their dinghies properly.

“You know, in all these cases, that the damage caused was through the neglect of these owners. This has not only resulted in increased damage to their own vessel and assets, but also significantly increased the damage to other people’s craft and assets – the innocent parties. In many cases, their (errant vessels) took part of the marina with them, collided with other vessels on the way, and it all adds up to a monstrous bill.

“It is pure negligence on the part of the owner who makes no effort to remove any loose parts, sails, canopies and covers. This type of owner is now going to pay the price, but unfortunately, they’re not the only one. With insurance everyone bears the brunt, because all insurance stems from just one pool.”

He points out that, as a result of the aforementioned storms (and other events), we now have a situation where many of the world’s underwriters (those who actually carry the financial risk attached to a policy) are running as far as they can from marine risk.

“Once one of the largest players in the marine insurance market, Lloyd’s has all but removed itself. A broker’s ability to go to Lloyd’s and place a risk has 95% evaporated. Many companies which still have cover holder agreements and relationships with the large underwriters are unlikely to have these renewed at the end of this policy period.

“We’ve been saying it for years – and now a lot of competitors are saying the same thing – the world has changed. The market in terms of the number of underwriters available to take on marine risk is around 35% to 40% smaller today than it was even 18 months ago.”

Naturally, this is affecting everyone’s ability to get cover. “There are a lot of individuals with good boats, who are good risks, seeing their premiums go up by 10, 15 even 20%. Yes, they complain that it’s not their fault, and they have not made a claim. Technically, that’s true, but unfortunately we operate in one big pool, and the supply into that pool has recently got a lot smaller.

“No matter where you are in the world, with insurance we are all joined at the hip. You could ask how is it that Caribbean storms or a superyacht burning in an European yard (€560m in damages) can affect someone in the Whitsundays, but the point is, we are all in this together.”

It’s not only marine policies that are affected, says MacPhail. “It can be equine, caravan, house, and events like the bushfires in California. The reality is that the end underwriter is one of the world’s biggest insurers – Lloyds, Alliance, Chubb, Berkshire Hathaway, ING. They’ll be one of the 10-15 in the group that makes up the significant bulk of the pool we’re talking about.

“In the past 24 months we have seen more catastrophes than in any other period before it. If you look at the available insurers to take on the risk, they have shrunk. Those that are left are much tighter, and their attitude is much stricter. Compliance is being enforced, and the expectation on the insured to perform their part is very much stronger than it has ever been.

“We have had no choice in our policy documents for 2019 to re-stress that it is your responsibility to make your vessel ready, and also to maintain it in a seaworthy manner in the first place. Items like clears on the flying bridge will not be covered, and neither should they be, for they will blow out in a storm, and that unnecessary loss only exacerbates the whole problem in what is already a tough market!

“It is incumbent on everyone to do their part, and if it does not happen, it is feasible that the world’s insurers will walk away from insuring marine assets, particularly for boats kept in areas where you could possibly get a named storm. There will be no cover at all. What are owners going to do then?” MacPhail points out that insurance companies have risk in many market sectors – marine, land, indemnity, aviation and motor. Natural disasters can affect these universally, so the companies need to have enough on their ‘book’ to remain solid, so that they do not sustain significant losses at the same time.

“So a company will look at its best risk, and also its worst, and if it’s losing money, the first one to go is the one at the bottom of the profit table. At the moment, the worst risk in pretty much everyone’s book worldwide is the marine risk, and this is why the pool has dried up.”

“If you leave your boat on a swing mooring in a tropical zone and don’t move it ahead of a storm up a creek or to another harbour, then really you have not shown any intention to mitigate the risk, and you will lose your asset. And it is not fair to think the insurance company will pay, nor is it fair that you think everyone should bare the brunt of it for you.”

He stresses that the great bulk of customers do prepare and do mitigate risk, and it is these people he feels for. “It is the minority that is now seriously affecting the majority, and there are still enough of them to affect the claims ratio of every insurer. This is one part of the reason for the premium increases you are now seeing.

“That minority need to take the negligence on board and appreciate what they have done to everybody. In storm-prone areas, you cannot leave you boat on a swing mooring. You can’t leave the sails on furlers, the bimini up, the dinghy on davits. This is not acceptable.”

Clearly, it’s going to get harder and more expensive to insure your marine asset. To ensure you’ll qualify for cover next year and the years after that, you do need to minimise the risk to your vessel, and thereby also those around you.

Ultimately, you’re protecting yourself. BNZ